Overview

Public Health Emergency (PHE) Medicaid Continuous Coverage 2019 - 2023

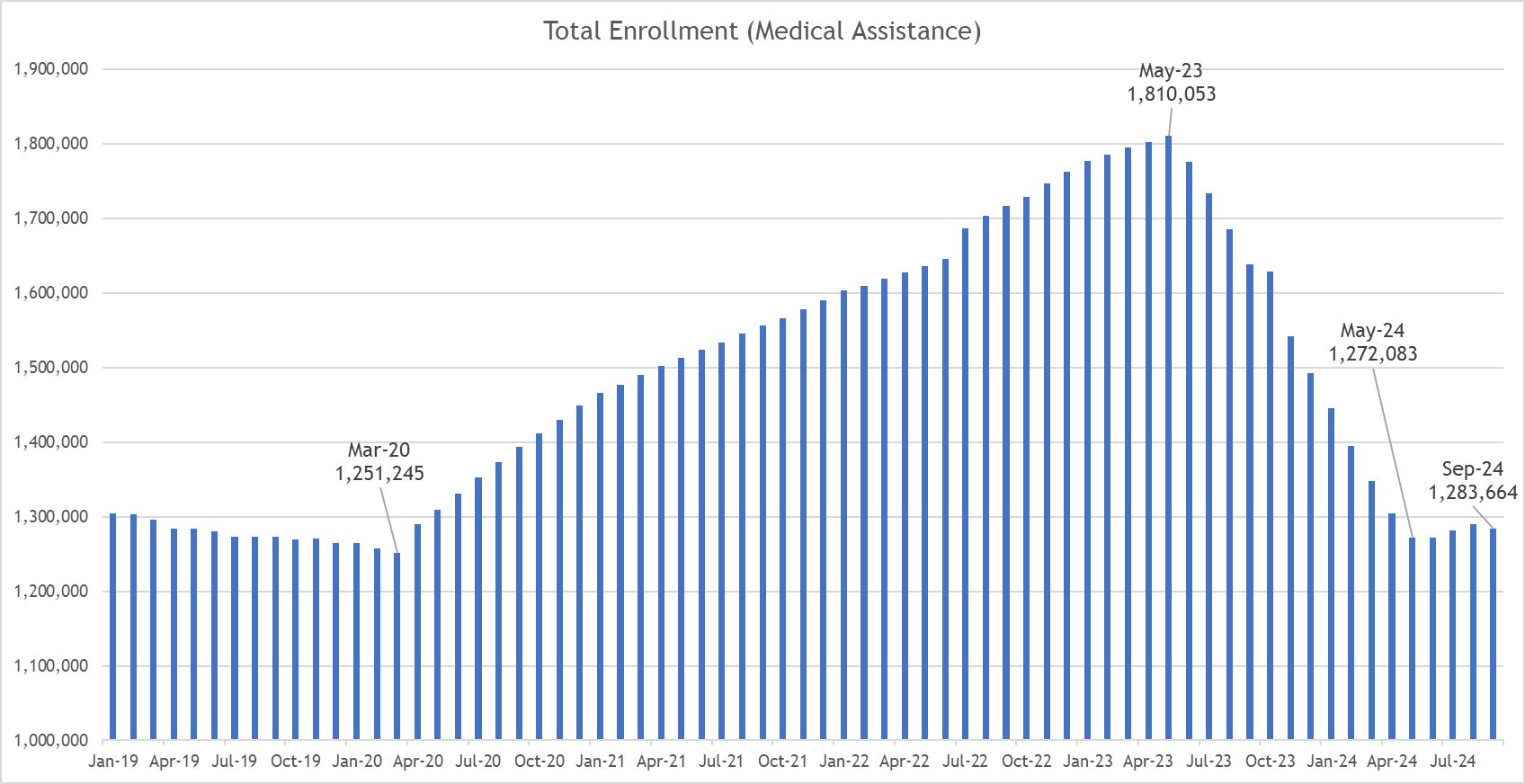

- The COVID-induced economic downturn caused hundreds of thousands of Coloradans to lose their jobs and with them, their employer sponsored health benefits. As a result, Health First Colorado (Colorado’s Medicaid program) rosters grew by 45%, one of the top states for membership growth during the PHE. We should all be proud of this result, which is a reflection of a massive, collaborative, unified effort to connect Coloradans to our safety net coverages when they needed them. More than 550,000 Coloradans were added to our safety net rosters during this time, meaning HCPF programs were covering 30% of Coloradans at our PHE enrollment high.

- While Colorado processed Health First Colorado and Child Health Plan Plus (CHP+) member renewals throughout the pandemic, members did not lose coverage if they were determined ineligible due to the federal continuous coverage requirement in place during the PHE.

Unwind of the PHE Medicaid Continuous Coverage May 2023 - April 2024

- When the federal government called an end to the public health emergency more than 3 years later, Colorado was required to act on renewal determinations, including disenrolling those who did not requalify for Medicaid or CHP+ (PHE Unwind). Every state is a little different; in Colorado, Medicaid is a state-supervised, county administered system. That means county departments of human/social services and specific Medical Assistance sites process Medicaid renewals.

- HCPF and its contracted partners outreached more than 2.4 million times via text, email, mailings and phone calls to about 711,000 Colorado households as of September 2024 to educate on what they needed to do to maintain their coverage. This outreach was in addition to a collaborative campaign with our partners who shared our toolkit messaging and a statewide Public Service Announcement (PSA) campaign (87,990 PSAs) in English and Spanish to raise awareness of the need for Health First Colorado and CHP+ households to renew their coverage through the PHE Unwind and to update their contact information to ensure their receipt of renewal information. Members were outreached at least four times, plus, an additional, final outreach to more than 350,000 households was completed in September educating those disenrolled from Medicaid on how to reconnect to Medicaid or connect to other coverage options, based on their unique circumstances.

- Colorado’s PHE Unwind leveraged the time CMS provided — 12 months, or 14 months including noticing. Notices began in March 2023 for members with renewals due in May 2023, while the last group of renewals in the PHE Unwind were due in April 2024. We aligned with existing member renewal dates to maintain member action consistency, return to normal renewal processes in an equitable manner, mitigate impacts to county and eligibility staff workloads, and align with tapering federal funding available to finance coverage for individuals during the 12-month PHE Unwind.

Post Unwind

- During the PHE, Medicaid and CHP+ membership grew by about 550,000. In alignment with HCPF’s February 2024 budget forecast, membership returned to pre-pandemic levels. Since the PHE Unwind, we have seen a slight, consistent increase in total enrollment.

- This historic unwind has been challenging for many members, families and health care providers. Throughout, we have collaborated with providers, patient advocates, counties, RAEs, other contracted partners, and more to achieve the shared goal of Keeping Coloradans Covered. The good news is that all post PHE Unwind metrics are reflecting systemic advances made over the last few years, to the betterment of the member experience and county eligibility processing workloads going forward. While all metrics are improving, we still have work to do to address the reality that some have experienced coverage loss, confusion, and difficulty maintaining coverage through the PHE Unwind.

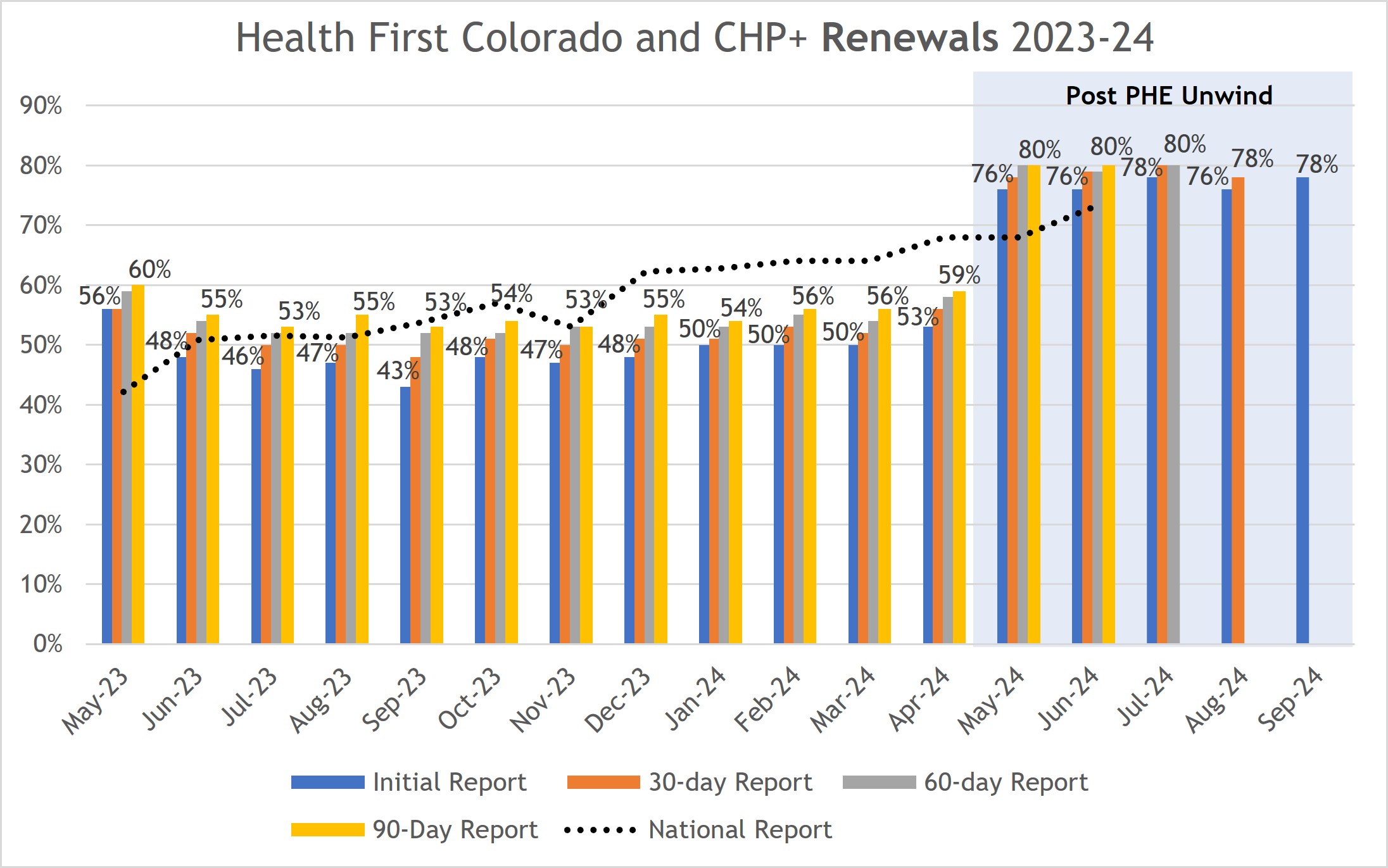

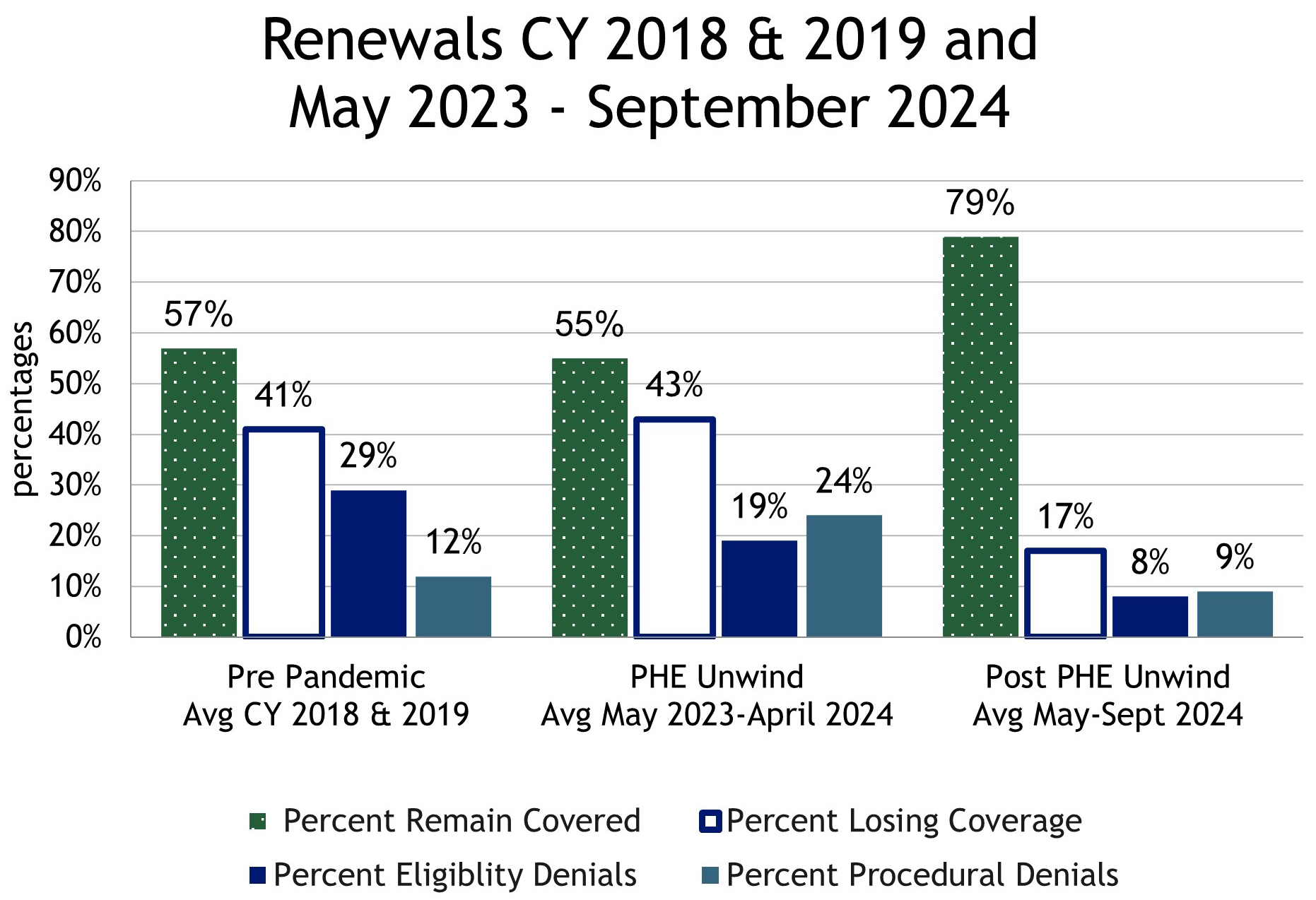

- PHE Unwind renewal approvals were within 2% of prepandemic norms (55% vs 57%), and disenrollments were as well (43% vs 41%). Since then, renewal rates have improved significantly. Renewal approvals are measured at the end of the respective month. Incorporating the 90-day reconsideration period, when members and counties submit renewal information or process renewals late, shows an additional increase:

- In May, 80% of renewals were approved (after the 90-day reconsideration period) compared to the initial 76%;

- In June, 80% of renewals were approved (after the 90-day reconsideration period) compared to the initial 76%;

- In July, 80% remain covered (after 60 days of the 90-day reconsideration period) compared to the initial 78%;

- In August, 78% remain covered (after 30 days of the 90-day reconsideration period) compared to the initial 76%;

- In September, 78% remain covered.

- Automation is critical to improving the member renewal experience and reducing county workloads. In May 59%, June 56%, July 62%, August 58% and September 63% of household renewals were completed through automation innovations (or ex parte). That’s a significant and meaningful improvement over the 33% average during the PHE Unwind. (Note: ex parte is only on renewal approvals).

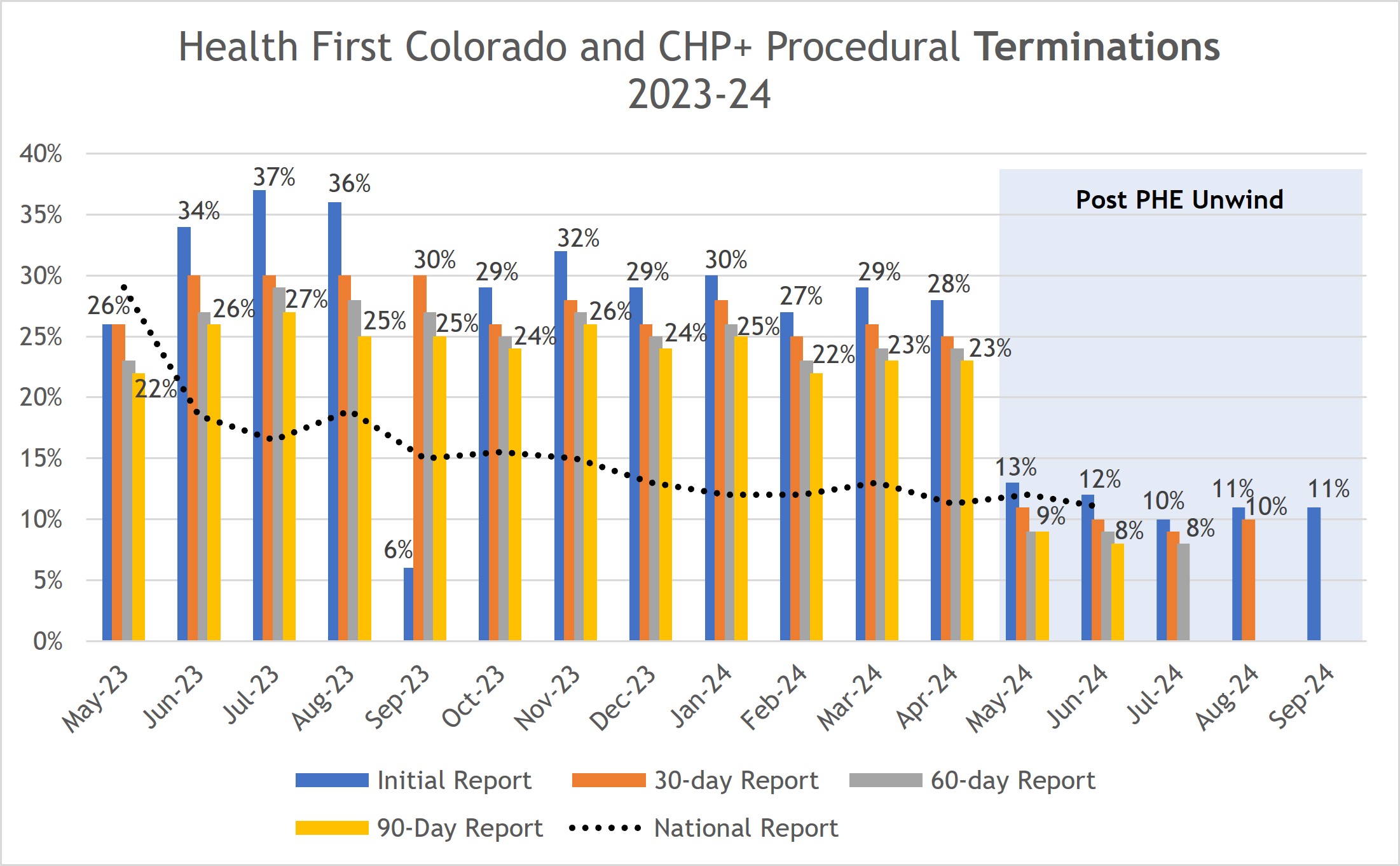

- Procedural denials are also below the 12% prepandemic levels, at 9% for May renewals (after 90 days), 9% for June (after 90 days) 8% for July (after 60 days), 10% for August (after 30 days) and 11% for September. While we still have work to do, this metric is moving in the right direction.

Improving Performance Across Numerous Metrics

As noted in the chart below, all metrics are headed in the right direction. Performance is getting better, but we still have a lot of work to do.

Prepandemic | Unwind | Post Unwind | |||||

|---|---|---|---|---|---|---|---|

CYs 2018- 2019 | May 2023- April 2024 | May 2024 | June 2024 | *July 2024 | Aug. 2024 | Sept. 2024 | |

| 78% | |||||||

62% - All **72% - MAGI | 58% - All **68% - MAGI | 63% - All **71% - MAGI | |||||

| 17% | |||||||

| 4% (after 60 days) | 4% (after 30 days) | 5% | |||||

| 6% | |||||||

| 8% (after 60 days) | 10% (after 30 days) | 11% | |||||

* July 2024 marked the implementation of additional automation for renewing members with incomes at and below the federal poverty level. This additional automation is due to a temporary flexibility (known as an e14 waiver) allowed by the federal government through June 2025. HCPF has urged the federal government to make this waiver permanent as it improves the member experience by reducing paperwork needed for renewals and reduces associated county workloads.

**MAGI is Modified Adjusted Gross Income or income based populations. In September 2024, MAGI accounted for 76% of total enrollment.

***Given the renewal volume, the processing backlogs that evolved through the PHE Unwind, our state supervised-county administered structure, and the investments needed in our eligibility systems and staffing to improve capacity and processing time, this 90-day reconsideration period is an important metric for Colorado.

Challenges Remain

While Colorado has worked hard to Keep Coloradans Covered, people and providers have struggled to navigate this massive transition. Despite our improvements, we have a lot more work in progress to ease eligibility processes for Coloradans. Our top priority remains to Keep Coloradans Covered, focused on making it easier for those who are eligible for Medicaid to renew or re-enroll. Key initiatives are to reduce the county eligibility processing backlog, increase the rate of automated and digital renewals, and improve communications. Further details on what we are doing are below.

Immediate Actions to Reconnect People to Medicaid

Colorado Medicaid is a state supervised, county administered eligibility and enrollment system. That means counties and eligibility sites process Medicaid applications and renewals. Below are the state actions to reconnect those who may still qualify to Medicaid:

- We outreached to more than 350,000 households who were previously enrolled with information on Coverage Options, including Medicaid.

- We are collaborating with county partners to work through any remaining renewal backlogs and work tasks to get members covered back to their renewal date, as appropriate.

- We continue to encourage providers to help get patients re-enrolled in Medicaid, where appropriate, when they show up for care without health coverage. For those who are found to be eligible, coverage can start on the application date and providers can be paid for those services for individuals found eligible.

- We are continuing to pause LTSS, Buy-In, and PACE disenrollments for all reasons (except for death and relocation out of state).

- We put in place a state centralized Return Mail Center to manage member contact updates and update addresses.

We are collaborating with key partners like Connect for Health and employer chambers to leverage the January 1 enrollment period going on now to further connect disenrolling Medicaid members to other coverage options.

We have ongoing work to improve operations in the following areas:

- Our renewal and new application automation (ex parte rates);

- PEAK performance, our member digital tool; and

- Eligibility correspondence clarity within 55 common member eligibility communications, with all letters updated by December 31.

Work in Progress to Further Improve Eligibility Determination Performance

Though Colorado’s renewal performance metrics have improved significantly, there is still more work to do to the betterment of our members and county partners, and we are committed to completing that work. Major initiatives designed to improve the eligibility process reflect our state-county partnership:

- Senate Bill 22-235 County Administration of Public Assistance Programs: A Long Term Plan that provides recommendations to improve county administration of eligibility and enrollment and related activities, including properly resourcing our state-county infrastructure, addressing county staff wage rate gaps, advancing the eligibility tools employed by county workers, and more. This report was released to the legislature on November 1.

- A funding request in FY 2025-26 HCPF/R-07 and CDHS/R-01 of nearly $44.5 million in new federal, State and local funding, which aligns with the above SB22-235 Report and aims to improve access to eligibility determinations for applicants and members and support counties administering HCPF and CDHS programs, including an increase in the number of county eligibility workers and their wages. This request demonstrates the State’s commitment to improving eligibility and enrollment processes while simultaneously supporting counties, who are on the front lines connecting Coloradans to public and medical assistance programs and supporting them through the enrollment process.

- Through the Joint Agency InterOperability (JAI) project, we will advance county consistency through the use of shared, universal tools that support counties in eligibility task management, including new applications, renewals, case changes and other tasks; dashboarding; document capture; and related critical work. Target implementation date: Anticipated 2026 - 2027.

- The Colorado Benefits Management System (CBMS) Vision & Strategy project is driving alignment and clarity around CBMS operational advances, infrastructure, and priorities. Target completion date: June 2025.

The above project solutions achieve shared goals prioritized between HCPF, CDHS, and our County partners. All of the above strategies will continue to improve the member experience and drive down Colorado’s procedural denials, which are administrative denials for issues other than income and other eligibility requirements as well as individuals voluntarily opting out of Medicaid coverage because they no longer need safety net coverage.

Where Are We Now? Returning to Prepandemic Enrollment Levels

For each of the 3 years prior to the pandemic, Health First Colorado and CHP+ membership had been declining in aggregate by about 3% annually, reflecting Colorado’s strong economy. During the PHE, Medicaid and CHP+ membership grew by about 550,000. Through the PHE Unwind, we tracked with the February 2024 estimate of a net enrollment reduction of 519,000 members. Post the PHE Unwind, we have a slight, consistent increase in overall enrollment (includes all medical assistance programs).

Through the PHE Unwind, members with higher medical needs have remained covered or returned to coverage, while those disenrolling had lower medical needs. This is causing a significant increase in the average per member per month (per capita) cost of Medicaid membership, post the PHE Unwind. This increase is above expectations and reflects a net 1.2% over-expenditure against our FY 2023-24 services budget projection. Many states are facing similar anticipated increases in Medicaid spending despite lower enrollment post unwind (KFF Brief & News 10/23).

Colorado’s Historic Approach to Unwind

The continuous coverage requirement locked individuals into coverage during the COVID-19 public health emergency (PHE). At the conclusion of the PHE, the federal government required all states to return to normal eligibility operations and review eligibility for members enrolled in Health First Colorado (Colorado's Medicaid program) and Child Health Plan Plus (CHP+) within 12 months.

HCPF and its contracted partners outreached more than 2.4 million times to about 711,000 Colorado households as of September 2024 to help members understand what they needed to do to retain Medicaid or CHP+ coverage, if that was their goal. The outreach leveraged health plan partners, providers and others to reach members via email, phone, text messages and mailings based on member communication preferences when it was their time to renew. Along with a statewide PSA campaign in English and Spanish, community partners accessed and helped distribute materials in 11 languages to raise awareness of renewals and encourage members to update their addresses. Thank you to the many community partners, advocates, health plan and other partners who did their part to help further raise awareness of the renewal process and for your direct member engagement throughout the renewal cycle to achieve shared goals.

Colorado opted to take the full 12 months (14 months including noticing) to review individuals enrolled by their renewal anniversary. This approach aimed to reduce member disruption and increase renewal results once the PHE Unwind began by continuing to align with Colorado’s ongoing practice to renew on a member’s coverage anniversary date, which Colorado continued throughout the PHE. The approach also ensured an equitable means of returning to business as usual renewal processing. It further recognized the impact to county and eligibility partner workload, given Colorado’s state supervised, county administered structure.

The twelve month approach also aligned with federal funding allocated to states to finance the cost of coverage during the PHE Unwind.

Enhanced Federal Matching Funding Reductions from the PHE Level of 6.5%

5%: April - June 2023

2.5%: July - September 2023

1.5%: October - December 2023

States have approached the PHE Unwind differently, making state to state comparisons difficult. Accurate comparisons between states can not occur until all states' Unwinding processes are complete, all pending applications are processed, the 90-day reconciliation timeframes have elapsed, and all final reporting is available.

Qualifying for Medicaid

To qualify for Medicaid, in many cases, a single person has to make less than $20,028 annually and a family of four less than $41,496 annually. For children to be eligible for CHP+, household income can be about double those figures. Given that criteria, Coloradans are less likely to qualify for Medicaid through the PHE Unwind if they secured a job as Colorado’s economy rebounded that provided income similar to the job they lost during the COVID-induced economic downturn. Economic factors further impact enrollment, as a standard, such as changes to the minimum wage or the unemployment rate. For example, Colorado’s minimum wage grew by 20% from 2020-2024 ($12.02 to $14.42) and Denver’s minimum wage increased by 42% from $12.85 in 2020 to $18.29 in 2024.

Renewal and Disenrollment Historic Comparison

We have also been tracking PHE Unwind data compared to historic norms (based on 2018 & 2019 calendar years). That analysis shows that the PHE Unwind renewals are tracking within 2% of prepandemic norms (55% vs 57%), while disenrollments are within 2% of prepandemic norms (43% vs 41%). While we still have a lot of work to do to improve the state’s eligibility system, the below post PHE Unwind performance illustrates that performance is moving in the right direction.

* May 2024-September 2024 numbers reflect the most recent data including changes during the reconsideration periods.

Procedural Denials

Our data indicates that our procedural denials during the PHE Unwind were far higher than historic prepandemic levels, while our income-based and other qualified eligibility-based denials were far below historic (about half). This is not unexpected; we expected that individuals who regained employment and the related employer-sponsored coverage during the PHE, would not consistently respond to our renewal inquiries, or our requests to verify income. The good news is that the procedural denials during the months of May through September 2024 — post the PHE Unwind — are now below the 12% prepandemic norm.

The bar chart below illustrates that procedural denials after the 90-day reconsideration period also decline significantly (blue bars to the gold bars). The shaded area to the right represents the post-PHE Unwind period, May through September 2024.

Importance of the 90-Day Reconsideration Period, Plus Emerging Data

The monthly data reported to the federal government represents a specific point in time within eight days after the close of the respective month. However, we know from historic trends that many members who still qualify leverage the 90-day reconsideration period to submit their renewal late to remain covered. Again, the reconsideration period provides an additional 90 days for individuals to turn in needed documentation or a completed renewal. The chart below shows renewals by month, incorporating the impact of the 90 day reconsideration period (gold bar). It also shows what was reported to CMS (blue bar, within 8 days of the end of the month) as well as progress 30 days after the end of the month (orange bar) and after 60 days (gray bar). The national averages are represented by the horizontal dotted line. Note the rising renewal rates for May through September 2024, (76% and increasing to 80% for May and June through the 90-day reconsideration period) post the PHE Unwind period, and 78% for September.

This chart shows the percentage of members renewed during the PHE Unwind grew by an average of over 6 percentage points and as much as 10 percentage points (removing May 2023, which included a late first submission) over the 90-day reconsideration period during the PHE unwind period as people continued to complete and turn in their renewal packets. We are seeing an uptick of 4% points post unwind as individuals turn in their materials or counties work the renewals in the 90-day reconsideration period.

Colorado disenrollment analysis also indicates that 33% of the Medicaid population disenrolled during the PHE Unwind have already requalified for Medicaid and have been re-enrolled. That compares to 42% returning prepandemic.

Long Term Strategies to Reduce Churn

In addition to the immediate and ongoing efforts in progress outlined above to make it easier for Coloradans that qualify to stay or get on Medicaid, we are also working on long term strategies to make it easier to stay on Medicaid for those that qualify. Such strategies include:

- Continuous Eligibility Coverage for Children 0-3 Years and for Adults Released from Incarceration has been approved by CMS, effective January 2026

- Expand Presumptive Eligibility in allowable eligibility categories for Hospitals (SB 24-116 and HB 24-1229)- pending federal approval, would be effective January 2026.

Transitioning to Other Coverage and the Associated Risks

Our shared goal has been to Keep Coloradans Covered. We are thankful for the many contracted partners, advocates, providers, insurance carriers, employer chambers, sister state agencies and other community partners who have collaborated on this important work. As employers begin open enrollment for their employees this month for January 1, it is more important than ever that they help employees navigate onto employer sponsored health benefits.

To mitigate the negative consequences of individuals being uninsured, and to help Coloradans navigate back onto employer-sponsored coverage, HCPF has created specific tools for employers and their HR departments. They are available at KeepCOCovered.com and Downloadable Resources: #KeepCOCovered.

Those over 65, and not actively working, should be enrolling into Medicare. That might include Medicare Advantage, available through commercial carriers or traditional Medicare.

Others may need to purchase individual or family coverage. The most affordable way to do so is through Colorado's Connect for Health marketplace exchange, which provides many options for health coverage as well as federal subsidies to make individual and family premiums and coverage more affordable. To help disenrolling Coloradans connect to the subsidies available through Connect for Health, HCPF provides customized files to Connect for Health Colorado to enable their outreach to disenrolling Medicaid members and to make sure those individuals know they are eligible for a subsidy.

Coverage Options for Coloradans

CHP+: HCPF is auto-enrolling eligible kids as part of the Medicaid redeterminations process. CHP+ enrollment has gone from a low of about 45,000 in May 2023 to about 90,000 in September 2024, even above prepandemic enrollment of about 79,000.

Employer Sponsored Insurance: Traditionally, more Coloradans tend to get their coverage through employer sponsored plans — about 50% — than any other type of coverage. Employers have annual open enrollment periods, opportunities to sign up when new employees are hired. Some employers may also offer special enrollment periods.

Family Member Employer Sponsored Coverage: Spouses, dependents, and children up to age 26 can be on their family’s employer plan.

Connect for Health Colorado: The state’s ACA marketplace. Premium and cost sharing subsidies are available below certain income thresholds.

OmniSalud: Coverage option for people who are undocumented or have DACA status. Immigration status not asked as part of application. Less than 150% FPL may qualify for subsidies. Program has an enrollment cap - that enrollment has been met for this year.

Medicare: Primarily for people over age 65. Penalties associated with late enrollment. People can qualify for Medicare and Medicaid (duals), where Medicare is main payor and Medicaid is payor of last resort and primary payor for long-term services and supports.

To apply for health coverage or programs, visit: colorado.gov/health

Supporting Member Renewals

Improvements Implemented:

- Enhanced Member Outreach

- Improved Automatic Renewals

- Shortened Renewal Packet

- Online Renewal Upgrades

- Improved Contact Info. and system changes to reduce Whereabouts Unknown denials

- Pause LTSS terminations for all reasons for two months (60 days) past the member’s original termination date (except for death and relocation out of state).

- NEW Webpage: Stabilizing Long-Term Services and Supports (LTSS)

- Automatically renew members earning less than 100% FPL when third party data sources return no information ($1,215/month individual, $2,500/month family of 4)

Improvements in Process (requires system updates and federal approvals):

- Automatically backdate coverage for those who renew during reconsideration period

- Enhanced outreach during reconsideration period

- Ongoing strategic advances in collaboration with counties and further improving member letters

Understanding the Affordability Transition Challenge

Medicaid provides robust coverage for zero premiums, zero deductibles and zero copays, except for the inappropriate use of the emergency room.

This is not the case with employer-sponsored insurance. We are fortunate that Colorado has made health care affordability a top priority, so we are in a better place than other states. Still, there is still a wide gap between Medicaid affordability and employer-sponsored health insurance affordability.

That reality is a significant influencer in the household budget decisions many individuals and families have to make as they choose between paying for health insurance coverage or other basics like rent, groceries, a car payment, gas or utilities.

In fact, our most recent insights into those disenrolling from Medicaid indicate that the older one is, the more they are prioritizing the purchase of health insurance while those who are younger are not connecting to coverage at the same rate.

Understanding the Medicaid Member Experience

HCPF partnered with the Colorado Health Institute (CHI) to conduct two surveys to capture experiential data from a subset of current and former Colorado Medicaid members. These subset populations do not comprise statistically representative samples; therefore, results cannot and should not be extrapolated as statistical representations of the PHE Unwind. As such, findings should be interpreted with caution and used to provide general or directional insights. They should not be extrapolated to represent the entirety of the disenrolling population, nor should they be used to establish normative rates such as the uninsured rate. Findings can inform opportunities based on the member experience feedback and help leaders frame strategies to address those opportunities. The CHI summary report, A Snapshot of Current and Former Medicaid Member Experiences, is published on our Annual Stakeholder Webinar page.

Point in Time: September Renewal Insights

Based on point in time information reported to the federal government eight days after the close of the month, 78% of Medicaid members were renewed in September, with about two-thirds of those approvals automatically renewed through advances in ex parte processing technology. 6% were disenrolled due to income or other eligibility requirements, while 11% were disenrolled for procedural reasons. Data is submitted to the Centers for Medicare and Medicaid Services (CMS) and is available on the PHE Unwind Reports page.